Many people complain about paying Medicare taxes. No one wants to pay if they do not feel they get something in return. When it comes to taxes though, they are getting far more Medicare benefits than they realize.

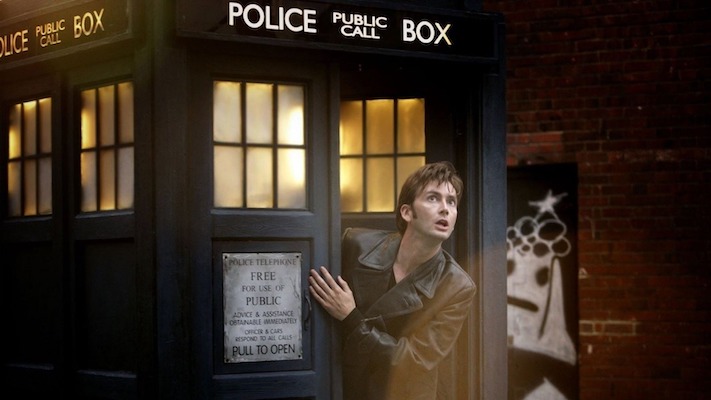

The Tardis of Medicare

Every Doctor Who fan knows what the Tardis is. For those who don’t know, it’s a time travel machine disguised as a blue police box. Whenever anyone steps inside this seemingly small box, they find themselves shocked by how big it is. There’s not only a control room but stairs and balconies and hallways, rooms and rooms of endless space. The running joke is that “It’s bigger on the inside.”

It’s not all that different when you think about Medicare. You think you are going to get something small when you pay your taxes but you get something much bigger.

By the Numbers

The Urban Institute has run the numbers for you and they have done so every year since 1992. They look at age, gender, marital status, and income (adjusted for inflation) as well as the amount paid in Medicare taxes. They then extrapolate how long someone is expected to live and how many Medicare benefits they are likely to use from age 65 onward.

Of course, it’s not perfect. Not everyone has the same income over their lifetime. Some people take time off or retire early. There are so many variable to consider! Still, the numbers provide a quick glimpse that shows you are likely to get what you put into the system and then some.

More Medicare Benefits for Single Individuals

The Urban Institute analysis is extensive, providing estimates every 5 years from 1960 all the way to 2060! I honed in on people turning 65 in 2025 since that is just around the corner.

That said, you may be interested to know that in 1965, no taxes were paid into Medicare (the program was enacted in 1965 but did not technically start until 1966) and expected lifetime health costs were only $31,000 then. Medical inflation has really taken a toll!

| Single Person Turning 65 in 2025 | Annual Income (in 2022 dollars) |

Estimated Lifetime Medicare Taxes |

Expected Lifetime Medicare Benefits* |

| Single Man | $28,200 | $45,000 | $289,000 |

| Single Man | $62,600 | $99,000 | $289,000 |

| Single Man | $100,200 | $159,000 | $289,000 |

| Single Man | $142,800 | $242,000 | $289,000 |

| Single Woman | $28,200 | $45,000 | $328,000 |

| Single Woman | $59,100 | $99,000 | $328,000 |

| Single Woman | $100,200 | $159,000 | $328,000 |

| Single Woman | $142,800 | $242,000 | $328,000 |

More Medicare Benefits for Married Couples

| Married Couple Turning 65 in 2025 | Annual Income (in 2022 dollars) |

Estimated Lifetime Medicare Taxes |

Expected Lifetime Medicare Benefits |

| One-earner couple | $28,200 | $45,000 | $618,000 |

| One-earner couple | $62,600 | $99,000 | $618,000 |

| One-earner couple | $100,200 | $159,000 | $618,000 |

| One-earner couple | $142,800 | $242,000 | $618,000 |

| Two-earner couple | $56,400 | $89,000 | $618,000 |

| Two-earner couple | $90,800 | $144,000 | $618,000 |

| Two-earner couple | $125,200 | $199,000 | $618,000 |

| Two-earner couple | $162,800 | $258,000 | $618,000 |

Is Medicare a Worthy Investment?

Looking at the numbers, you see that a single man gets a return on investment ranging from 1.2 to 6.4 times what they pay into it. A single woman gets 1.4 to 7.3 times as much. A married couple with one earner gets 2.5 to 13.7 times as much and a married couple with two earners 2.4 to 6.9 as much.

For all intents and purposes, Medicare is a worthy investment. You get more than you give. The question is how can the federal government manage those tax dollars and put them to good use?

References

Retirement & Survivors Benefits: Life Expectancy Calculator. SSA.gov. https://www.ssa.gov/oact/population/longevity.html

Steuerle, C., & Smith, K. Social Security & Medicare Lifetime Benefits and Taxes: 2022. Urban Institute. https://www.taxpolicycenter.org/publications/social-security-medicare-lifetime-benefits-and-taxes-2022/full

US Health Care Inflation Rate. Ycharts.com. https://ycharts.com/indicators/us_health_care_inflation_rate

Leave a Reply